C&RT spent less on maintenance last year

September 2017 - With boaters questioning on social media why C&RT spent £900,000 less on dredging last year and the upcoming Annual Meeting, Allan Richards takes a look at what the last four Annual Reports tell us about the Trust's spend on maintenance.

Despite a substantial growth in income and and the value of its investments, the Trust's yearly spending on waterways maintenance is not increasing. Indeed, it actually spent £1m less less on directly maintaining its waterways in 2015/16 than in the previous year.

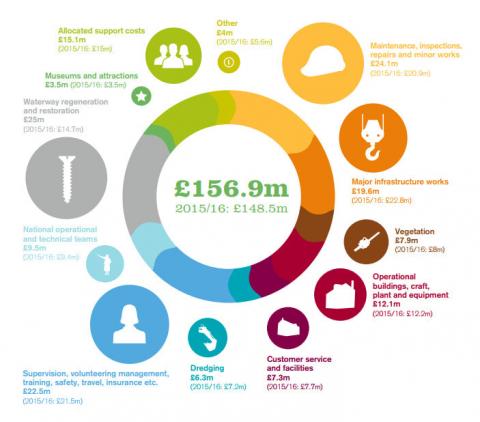

C&RT's financial years runs from 1 April to the end of the following March. We are looking at the financial years of 2013/14, 2014/15, 2015/16 and 2016/17. In its annual reports, C&RT provides doughnut charts showing income, expenditure, and investment by type. Let's take expenditure first. C&RT categorises its expenditure under twelve headings:-

- Maintenance, inspections, repairs and minor work*

- Major infrastructure works (i.e. projects costing over £50,000)*

- Vegetation, waste and contract management*

- Operational buildings, craft, plant and equipment

- Customer service and facilities

- Dredging*

- Supervision, volunteering management, training, safety, travel, insurance etc.

- National operational and technical teams

- Waterway regeneration and restoration

- Museums and attractions

- Allocated support costs

- Other

The problem with this is that, whilst it can be seen that the four categories marked with an asterisk directly relate to maintenance of C&RT's waterways and the ability of boats to use them, some other categories have a portion of spend that is indirectly related but can not be separated out. For example, operational buildings are used both by staff who maintain the waterways and those who have different functions. However, the Trust provides no split.

As such, we will concentrate on the four direct maintenance categories -

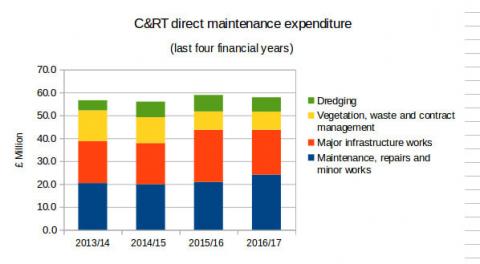

Spend on maintenance, repairs and minor works was £24.1m last year, some £3.2m up on the previous year. Conversely, spend on major infrastructure works was £19.6m, £3.2m down. Taken together the spend of £43.7m was the same as 2015/16.

It is worth noting that, despite this £43.7m spend, the number of recorded defects on C&RT's waterways rose by 15% last year from 62,397 to 72,026 - it's now 36 defects for each linear mile of waterway.

Dredging spend was £6.3m, some £0.9m down on the previous year. One has to ask if C&RT is quietly abandoning it's 'dredge pledge' - its commitment to spend £80m over a 10 year period. Over the last four years it has only averaged about £6m per year rather than £8m and is now actually decreasing spend.

It should also be noted that a response to a request for information a couple of years back indicated that it actually needs to spend £9.7m a year (increasing at 3% per year) just to stop its dredging backlog increasing.

However, it is the Trust's vegetation, waste and contract management spend that holds the big surprise. Whilst its spend of £7.9m is only £100,000 short the previous year, it has decreased by a staggering £5.5m (from £13.4m to £7.9m) over the last four years.

In total, C&RT spent £1m less last year on the four 'direct maintenance' categories, than it did the previous year. As will be seen from the chart spend has been fairly static over the last four years being within a few hundred thousand of £57m.

Over the same period, the number of recorded defects on C&RT's waterways has risen from 42,802 (1 April 2013) to 72,026 (1 April 2017), an increase of 68%.

Fairly obviously, using the measures of recorded defects and C&RT's admission that it should be spending at least £10m pa on dredging, C&RT is dramatically underspending on maintenance. With maintenance spend more or less flat-lining (and actually decreasing in real terms) the question has to be asked - 'Can C&RT afford to spend more on maintenance?'.

The answer is an emphatic yes! Let's take a look a C&RT's income.

Incoming resources, as C&RT calls its gross income, has grown by £40.3m from from £162.6m (2013/14) to £202.9m (2016/17). Government grant, which forms part of that income has increased by £11m from £39.0m (2013/14) to £50.0m (2016/17).

Boaters contribution to 'incoming resources' from licences and mooring (including C&RT's marina subsiduary,BWML) has grown by £5.7m from from £39.0m (2013/14) to £44.7m 2016/17.

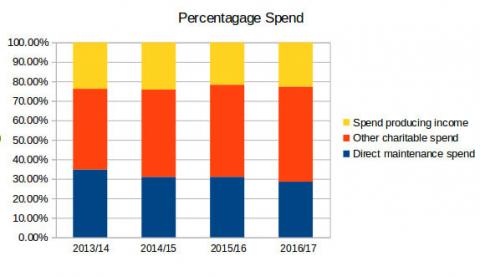

However over the same four year period, direct maintenance spend remained relatively unchanged, increasing by just £1.3m (2013/14 - £56.6, 2016/17 - £57.9).

Looking at income in percentage terms -

- Total income has risen by 25%

- Government grant has risen by 28%

- Boater income has risen by 15%

Over the same four year period, direct spend on maintenance rose by just 2%.

Fairly obviously, C&RT's increase in income over the last four years is not being reflected in expenditure on maintenance ...

Now let's look at C&RT's (mainly property) investments over the same four year period. Four years ago, these were valued at £507.1m. Now they are valued at £787.4m, an increase of 55%.

Despite the 55% rise in the notional value of C&RT's investments, the rise in net income produced from them is almost zero. Net income (i.e. gross investment income minus management costs) was £30.3m in 2013/14 and £30.5m last year - an increase of just 0.007%.

Their chart shows maintenance spend as a percentage of income. Whilst, C&RT makes much of its rising income, the fact is that the proportion of income spent on directly maintaining the waterways has fallen from 34.8% to 28.5%.

Two significant events occurred last financial year. Firstly, C&RT's pension fund liability, which it plans to reduce to zero over 15 years, has instead more than doubled from £51.4m (2015/16) to £116.1m (2016/17).

Secondly, C&RT has borrowed £50m using its non-operational assets as security. This loan is in addition to a £12.9m loan from Port of London Properties inherited from British Waterways.

However, it would appear that this money will not be used to increase spend on waterways maintenance but rather to invest in additional (mainly property) assets in the hope that any return will be greater than the repayments.

As with British Waterways before it, C&RT seems fixated on managing its non-operational assets (mainly property) at the expense of maintaining its operational assets - the waterways that have been entrusted to it.

Photos: Charts and graphs from CRT.